Another quickie from the past.

Most fund managers are either classed as Growth Managers or Value Managers. Research rating houses love to categorise fund managers as one or the other, in the apparent belief that investors would like to have their portfolio managed in one particular way or the other.

I’m Eclectic in style, and periodically change the emphasis of the portfolio selections from growth to value and back again depending on how I perceive the relative value and relative risk of each.

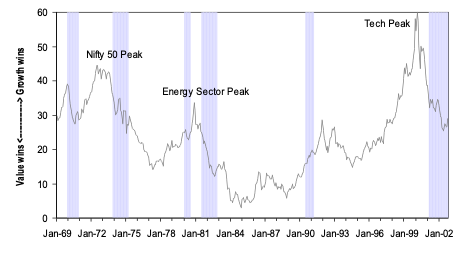

The old graphic below shows there is a definite cycle in the relative performance of the two, and this is another definite opportunity to add value over time. Growth stocks can outperform for years at a time, but then eventually, typically in the aftermath of bear markets, come back to earth with a vengeance while Value stocks make the running and have their day in the sun. 1972, 1981, and 1999 were classic tops.

It is probably true that an excellent picker of value stocks can usually do as well over the longer term as an excellent picker of growth stocks, because of the higher contribution of growing dividend income. It is almost certainly true that a portfolio of well chosen value stocks will represent a lower capital risk portfolio than one devoted to high growth stocks.

In the graphic, a rising graph shows growth stocks are outperforming value stocks. A falling graph line shows value stocks are outperforming. It doesn’t take much extrapolation to work out that in the present day, 2023, we are probably once again in the latter stages of another tech driven cycle, epitomised by Tesla and Apple. At such peaks there is usually some extreme cases, and this cycle has the incredible fascination with Crypto which peaked in November 2022, but hasn’t yet gone away. There is a likelihood that value stocks may do relatively better in 2024 and for longer than recent cycles. After the nifty 50 peaked (Xerox and the like) Value stocks outperformed for most of the next twelve years, hence the emergence of “value managers” in the eighties, just when it was time to buy Microsoft!.